Throughout 2024, significant milestones in governance have been recorded, shaping the agenda of Madrileña Red de Gas.

- Appointment of Ms. Carmen Gómez de Barreda Tous de Monsalve as an independent member and new Chair of the Board of Directors.

- Continuation of the process of supervision and evaluation of regulatory compliance, ensuring the adequacy of internal controls and risk monitoring.

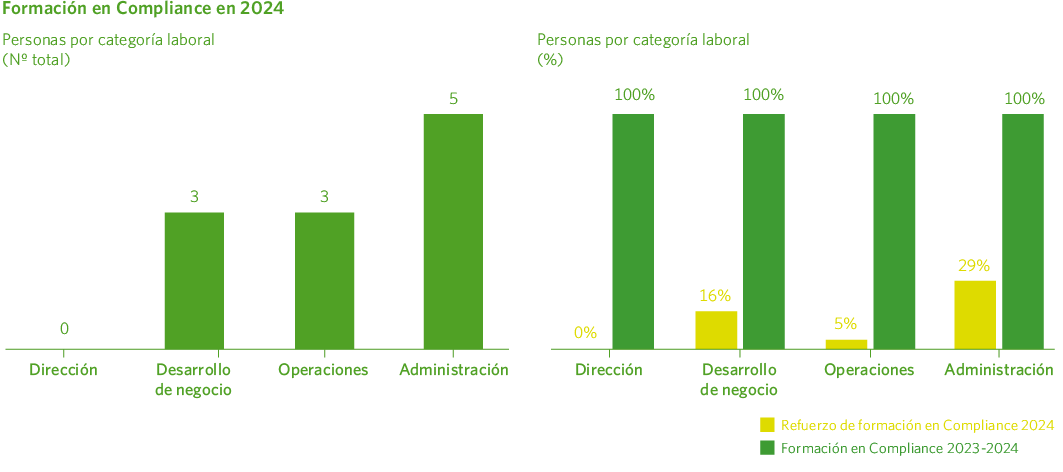

- Update and strengthening of the training delivered in 2023 in the area of Compliance.

- Key matters analyzed by the Board: cybersecurity, sustainability and the integration of ESG (environmental, social, and governance) criteria, strategic planning, the new regulatory framework for the gas sector and the industry, and energy transition commitments; financial management and capital structure.

- Review of the Board of Directors’ skills matrix.

- Strengthening of competencies regarding the requirements of the new sustainability reporting framework.

- Board initiatives promoted by PGGM as a result of the Operational Due Diligence carried out by PGGM’s risk team./li>

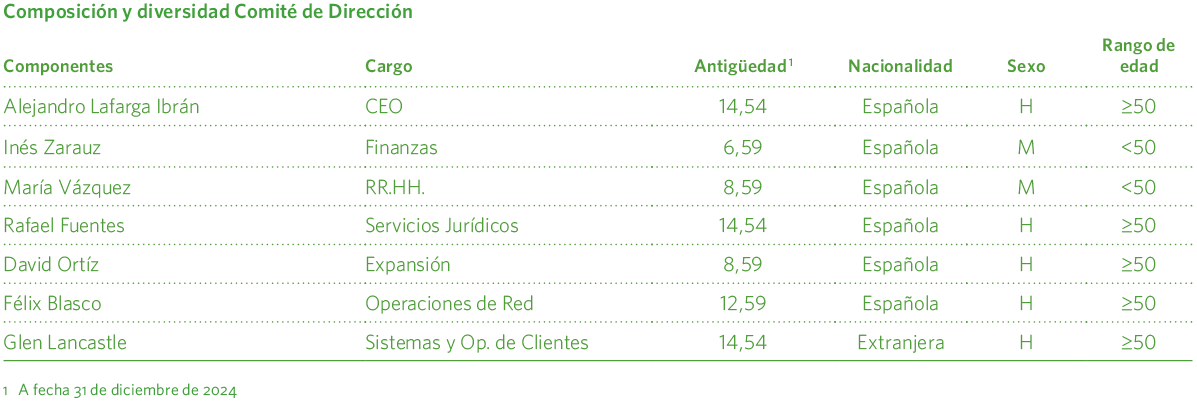

Principales indicadores 2024

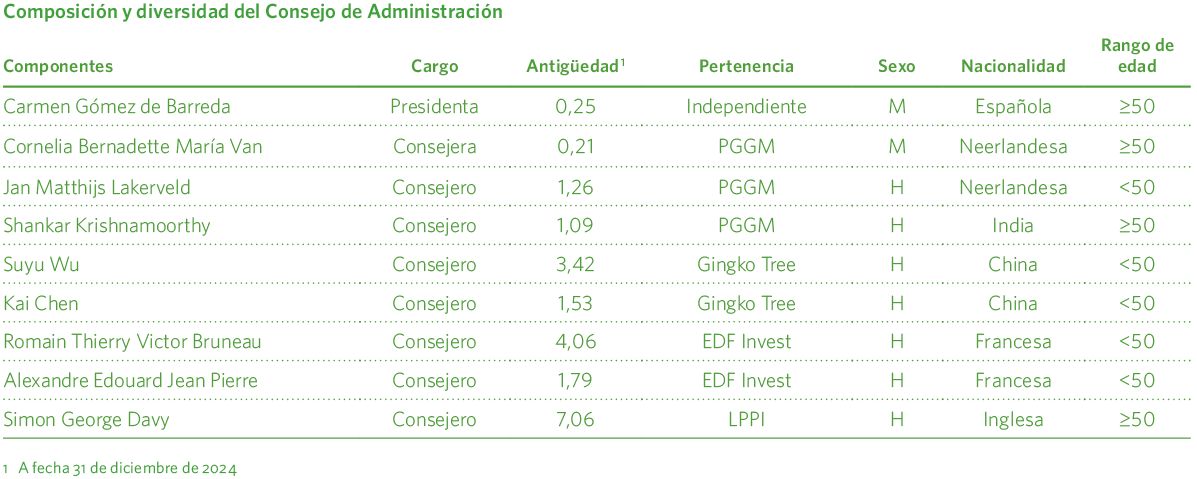

- Diversidad género Consejo 78% (H) y28% (M)

- Diversidad edad Consejo: 56% (<50) y 44% (≥50)

- Edad promedio Consejo: 47,8 años

- Antigüedad promedio cargo Consejo: 2,3 años

- No existen multas o sanciones derivadas del incumplimiento legal.

- Cero denuncias en el canal de denuncias derivadas del Código Ético o Compliance.

- Formación en Compliance bienal (100% empleados)

- Formación en puesto de riesgo (100%)

- Cobertura de procesos monitorizados y evaluado del sistema de Compliance (100% procesos completados con éxito)

- Cero ineficiencias encontradas en la monitorización de Compliance.

- Porcentaje proveedores con riesgo penal alto (47%) y con riesgo muy alto (0%)

- Ningún incumplimiento asociado a la corrupción de socios y colaboradores.

- Ningún riesgo de vulneración de los Derechos Humanos materializado.

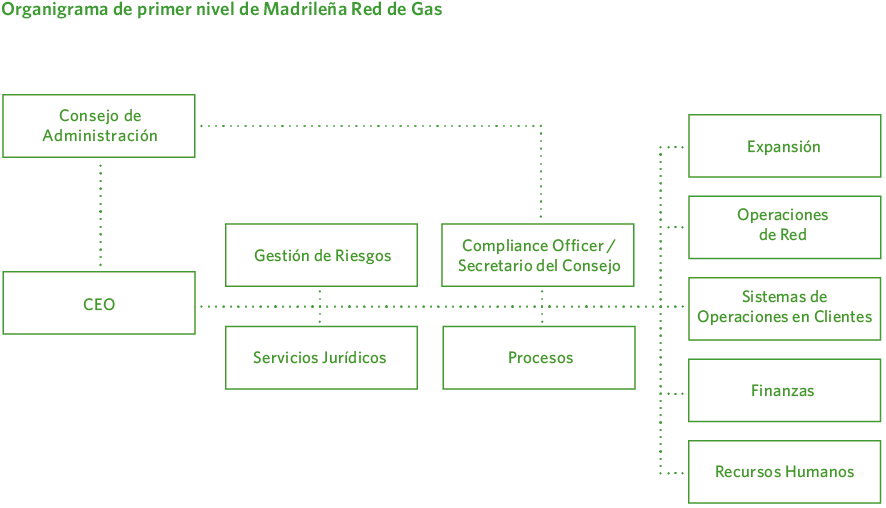

3.1Corporate and organizational structure

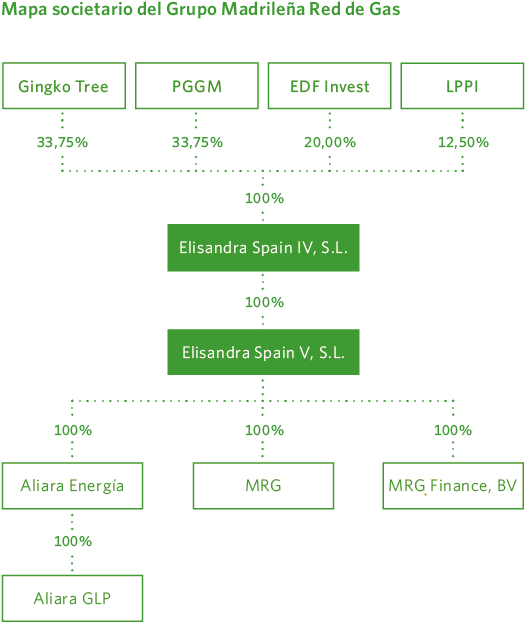

Elisandra Spain V, S.L.U., as the sole shareholder, is controlled by the parent company Elisandra Spain IV, S.L. In turn, the latter is linked to four main investor groups and business partners who hold various ownership stakes and voting rights: Realgaz, S.A.S (EDF Invest), Stichting Depositary PGGM Infrastructure Funds (PGGM), JCSS Mike S.A.R.L. (Gingko Tree), and LPPI Infrastructure Investments LP (LPPI).

In order to reinforce the separation and transparency of the regulated gas distribution activities from other business activities, a group of independent companies has been established, fully owned by Elisandra Spain V, S.L.U.

The structure of Madrileña Red de Gas is reviewed periodically and adapted to the strategic, organizational, and process needs required by the Strategic Plan. The structure reflected corresponds to the closing of the fiscal year in December 2024. It is worth noting that during this last year, changes occurred in the Expansion Department as a result of the strategy towards new business models.

3.2Sustainability governance

The governance structure is composed of the Board of Directors, the Audit and Risk Committee, the Remuneration Committee, and the Executive Committee. All of these bodies include representation from the four partners of Elisandra Spain IV, S.L.

For the appointment of governance bodies, the main element is shareholder representation in most of these control bodies, providing a mechanism for oversight and independence in decision-making. On the other hand, in line with the Code of Ethics and the commitment to diversity, there is no discrimination based on age, gender, origin, religion, etc. However, due to the company’s history and the gas sector in general, a male majority still exists within its governance bodies, which is a key area where efforts are being made to reduce disparities.

In addition to this structure, there are a number of Committees and Commissions that include members of Management, providing technical support to governance responsibilities. Among them, the following stand out:

- SIG Committee.

- Cybersecurity Committee.

- Crisis Committee.

- Health and Safety Committee.

- Major Accident Prevention Committee.

- Works Council.

- Ethics Code Commission.

- Equality Plan Monitoring Commission.

- Pension Plan Control Commission

Board of directors

The Board of Directors is the form of governing body established in the Bylaws registered with the Commercial Registry and acts collectively. Its members, individually, are all non-executive shareholder representatives, unlike the Executive Committee, which includes executive members. The system for the selection and appointment of Board members is expressly regulated in the Bylaws and in the Rules of the Board of Directors.

The Board is a collegiate body, so there are no significant positions beyond the existence of a Chair of the Board. Its resolutions are executed by the Company’s Chief Executive Officer, the sole person who, together with the Chief Financial Officer and the Finance department, holds general powers of management, administration, and decision-making. Its operation is governed by the bylaws and by the rights, duties, and obligations established in the Companies Act.In summary, Board members are proposed by the Board of Directors itself, and their appointment is approved by the sole shareholder, in accordance with legal provisions.

As part of the commitment to advancing the implementation of best corporate governance practices, significant progress was made in 2024 with the inclusion of two women as members of the Board of Directors, one of whom assumed the Chairmanship as an independent member. This milestone strengthens the commitment to equity in the company’s leadership, reflecting the intention to build more inclusive and representative governing bodies.

Board members are proposed by the Board of Directors and their appointment is accepted by the sole shareholder, in accordance with the law. The current Chair of the Board is independent, thereby ensuring greater objectivity in oversight and decision-making. The other members are proposed by the different investors and mostly serve on the boards of other organizations within their shareholder groups. The term of office is six years. Currently, the average tenure of Board members is 2.3 years.

Regarding the professional profiles of the Board members, they are highly qualified professionals for their roles, with extensive professional experience and having held senior positions in functions related to their duties.

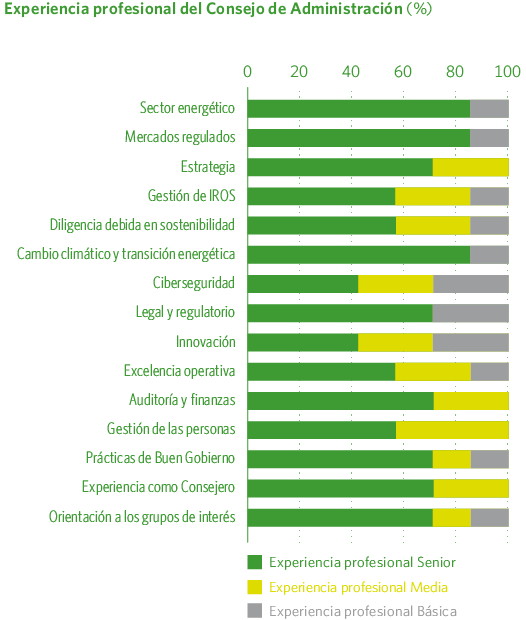

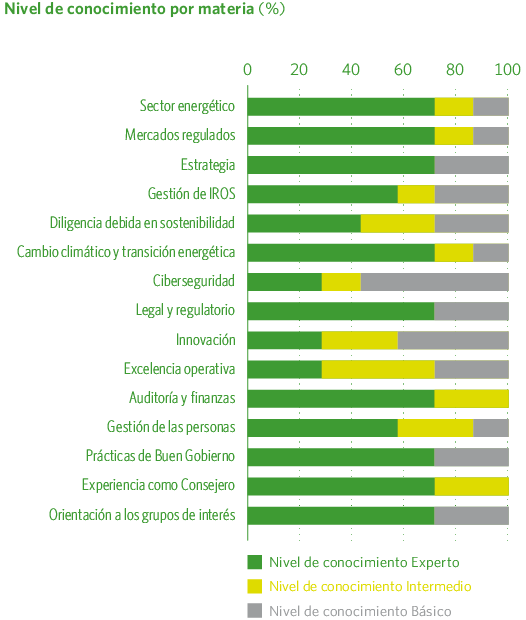

Currently, aligned with best corporate governance practices and the new requirements in sustainability and GRI standards, a Board of Directors skills matrix is in place, reflecting the competencies, experience, training, and knowledge levels of the Board members.

In 2024, in line with the new sustainability context, a review was carried out of the Board’s strategic competencies in sustainability, as well as the incorporation of three levels for each element to be evaluated.

As shown in the graphs, the matrix consists of the following elements:

- Competencies: a total of 15 core competencies are evaluated, relevant to the sector and the company’s strategic priorities, as well as new knowledge required to take appropriate actions regarding sustainability impacts, risks, and opportunities.

- Professional experience: evaluation of professional experience in the relevant area.

- Level of acquired knowledge: gained either through specific training or through on-the-job training and professional experience.

This matrix is reviewed periodically (at least every two years) or whenever there are changes in the composition of the Board of Directors or in the company’s strategic priorities. In 2024, due to changes in some Board members, a new self-assessment was carried out.

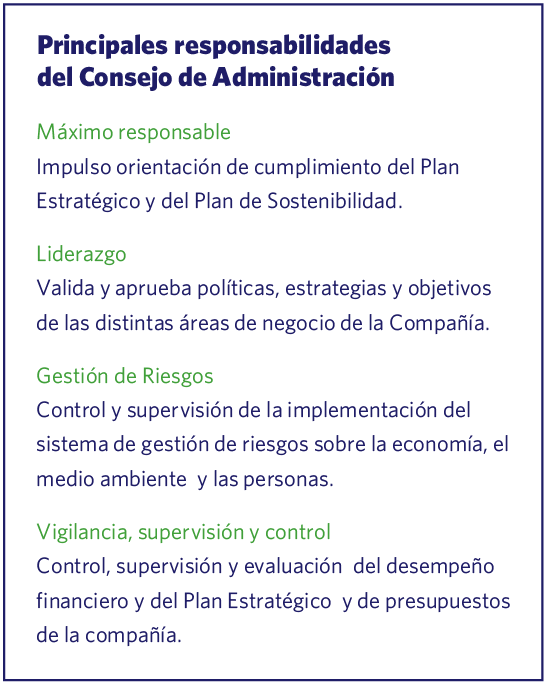

Main responsibilities of the Board of Directors

The Board of Directors, as the highest governing body, defines the Company’s overall strategy, validates management strategies and objectives, and oversees organizational results in economic, environmental, and social areas.

Sustainability policies, strategies, and objectives — including economic, environmental, social aspects, and due diligence in Human Rights, as well as the analysis of material topics — are defined by the Risk area, approved by the Audit and Risk Committee, and reported to the Board of Directors for validation as part of the management process.

The responsibility for sustainability reporting and its subsequent verification has been delegated to the Audit and Risk Committee. Once validated by the Executive Committee, these matters are presented to the Board of Directors in the relevant Committee.

Board meetings are held at least quarterly. Preliminary dates and agendas are established and approved each December, thus ensuring advance planning of the topics to be addressed during the following fiscal year. Based on this initial agenda — which may be modified depending on circumstances — area directors, members of the Executive Committee, and the company’s various committees prepare detailed analyses of economic, social, and environmental issues, which are presented at each Board meeting for deliberation and decision-making.

Among the topics discussed by the Board of Directors during 2024, key issues for the company stand out, such as cybersecurity, aimed at strengthening protection against technological threats; sustainability and the integration of ESG (environmental, social, and governance) criteria, in line with industry best practices and energy transition commitments; monitoring of the regulatory framework, with special attention to strategic planning for the upcoming gas regulatory period (2027-2032); the evolution of the energy market and technological innovation applied to the transition toward a more sustainable energy model; and financial management and capital structure, focused on ensuring stability, optimizing profitability, and evaluating new investment opportunities.

Over the past four years, the integration of sustainability into corporate governance and business decision-making has been consolidated

The Board of Directors, as the highest governing body, defines the Company’s overarching strategy, validates management strategies and objectives, and oversees the organization’s results in economic, environmental, and social areas.

The organization’s processes are, in turn, defined by the Executive Committee and communicated to the Board of Directors whenever there may be a significant change. The Board Secretariat, in accordance with the provisions of the Companies Act, plays a key role in assisting the Board of Directors, ensuring compliance with legal requirements and internal regulations, safeguarding corporate documentation, and guaranteeing the correct adoption and formalization of Board resolutions. Additionally, it oversees the observance of good governance principles, provides legal advice, and ensures transparency in decision-making processes. It is also responsible for communication between the directors and the Executive Committee, channeling all communications and notifications addressed to the directors.

Over the past four years, the integration of sustainability into corporate governance and business decision-making has been consolidated. This commitment to sustainability has materialized in a clear focus within the corporate strategy, driving medium- and long-term sustainable development, as reflected in the Sustainability Master Plan and the achievements attained so far.

The Board of Directors supervises and approves decisions and progress on sustainability matters, delegating executive functions to the Audit and Risk Committee. During its meetings, it analyzes the period results presented by the Executive Committee to monitor and define strategies, oversee operations, discuss matters of relevance to the organization, assess risks and opportunities arising from impacts on the economy, environment, and people, and consider stakeholder opinions. Upon request from members, detailed information on any pertinent issues is provided.

Again this year, aligned with PGGM’s interest in progressively meeting SFDR requirements and following the Due Diligence conducted in this regard, ad hoc meetings have been held to inform and report on requested requirements and information, providing a highly positive perception among all investors regarding the approaches and methodologies developed to respond to new CSRD and GRI requirements, as well as Madrileña Red de Gas’s sustainability strategy.

In 2024 the company improved its average debt costs, reaffirming its commitment to sustainability through a loan linked to the score obtained in the GRESB sustainability index

Aware of the impacts of climate change and the energy transition on the company’s current and future activities, and as a result of the commitment to sustainability undertaken years ago, ESG-related topics have been systematically and periodically introduced into the Board’s agenda. These include climate change impacts, the greenhouse gas (GHG) net emissions strategy and plan, GRESB index evaluation results, monitoring of the Sustainability Master Plan, and increasing reporting requirements. This participation encompasses decisions regarding risks and impacts on the economy, people, the environment, and human rights, which may affect Madrileña Red de Gas’s short-, medium-, and long-term corporate strategy.

Financial performance control and evaluation by the highest governing body are carried out through the annual financial audit at year-end, which, in compliance with Law 11/2018 on Non-Financial Information and Diversity, provides non-financial information verified by an independent third party.

Furthermore, in the current market context where shareholders and investor groups increasingly prioritize investments in sustainable and socially responsible companies, it is worth noting that in 2024 the company improved its average debt costs, reaffirming its commitment to sustainability through a loan linked to the score obtained in the GRESB sustainability index.

Within this Board, three control bodies have been established: the Audit and Risk Committee, the Remuneration Committee, and the Criminal Offense Prevention Committee. Each has specific tasks and reports to the Board.

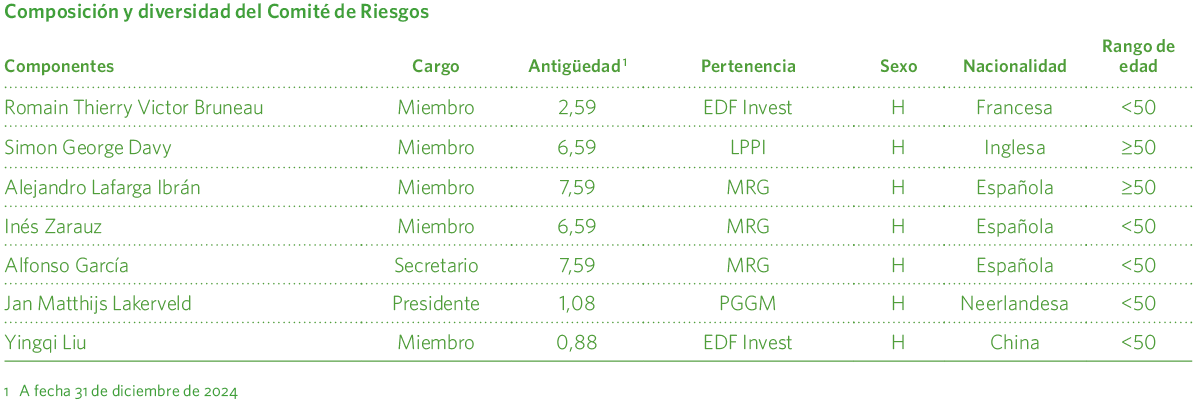

Audit and Risk Committee

The Audit and Risk Committee (ARC), composed of members of the Board of Directors representing the four investor companies, the CEO, and the Head of the Risk Management Department, (Image 10) monitors corporate risks, as well as the identification, analysis, and assessment of their impacts on the economy, the environment, and people. In line with the recent appointment of new board members, two new members have been designated to the ARC.

At the proposal of members of the Management Committee, any threat with potential impacts on the economy, the environment, and people may be subject to analysis in order to determine the likelihood and magnitude of the impact, as well as to define the corresponding mitigation plan.

At Madrileña Red de Gas, a process has been defined and implemented to determine the double materiality of sustainability-related matters, which involves and promotes the participation of stakeholders and gathers their perception of the organization’s performance in each material aspect. This Sustainability Report includes the results of this analysis from the perspective of double materiality, with the endorsement and approval of the Board of Directors.

As established in the internal operating regulations, the Audit and Risk Committee reports directly to the Board of Directors and operates in accordance with the provisions set out therein, which define its objectives, functions, and composition. This committee is made up of representatives of the Board of Directors from each of the four shareholders, several members of the Management Committee, and the Risk Management Department.

At the proposal of members of the Management Committee, any threat with potential impacts on the economy, the environment, and people may be subject to analysis

The agenda items are addressed in regular committee meetings, held prior to each Board of Directors meeting, and are internally agreed upon at the beginning of each new fiscal year.

The Audit and Risk Committee is in charge of:

- Supervision and control of processes, channeled through the SIG Committee.

- Presentation of the results of the financial audit and external verification.

- Monitoring the effectiveness of the internal control and risk management system.

- Monitoring of the criminal compliance policy and oversight of the Compliance system.

- Development and updating of the Mission, Vision, Values, and policies, which are subsequently approved by the CEO and presented to the Board of Directors.

- Development and monitoring of the Sustainability Master Plan.

- Follow-up on relevant matters and objectives related to Sustainable Development, as well as the organization’s due diligence in addressing and managing impacts.

- Preparation and presentation of the sustainability report, which is reviewed and validated by the Management Committee and the Board of Directors.

Among the most recurrent topics are the monitoring of the corporate risk map (including operational, technological, regulatory, economic, social, environmental risks, as well as those arising from climate change, cybersecurity, and reputational risks), the controls and mitigation plans established or proposed, the financial audit, audits of the integrated prevention, environmental, quality, and information security management system, matters relevant to sustainability, development and monitoring of the Sustainability Master Plan, ESG indicator dashboard, alignment with new sustainability reporting requirements, the annual review of the criminal compliance policy, and the monitoring of the Compliance system. The outcome of these activities enables the issuance of recommendations aimed at risk management and/or the Board of Directors.

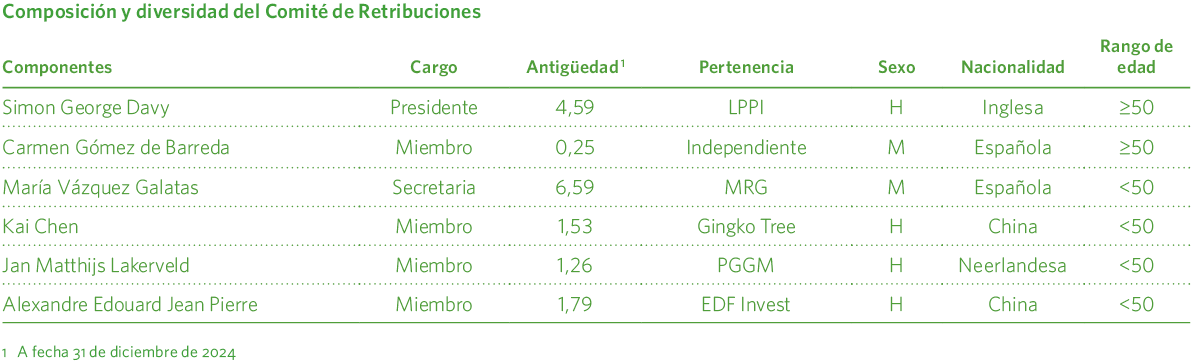

Remuneration Committee

Shareholder involvement in senior executive remuneration is exercised through the Remuneration Committee, which is composed of the Chair of the Board and up to four other Board members. As with other Committees, due to changes in Board members appointed by shareholders in 2024, this Committee has also incorporated a new member, maintaining a gender diversity ratio of 2:1.

The CEO and the Human Resources Director (who acts as Secretary) attend the meetings, except when their own remuneration is being discussed. The CEO is considered part of the Senior Management, and their compensation is set annually by the Remuneration Committee. Board positions are unpaid, in accordance with the Company’s Bylaws.

The Remuneration Committee determines and recommends to the Board of Directors the remuneration policies and any changes to the terms of service for the CEO, the CFO, and any other member of the Management deemed appropriate to consider, as well as other employees.

The Remuneration Committee is responsible for all elements of compensation for the Business Unit Directors of Madrileña Red de Gas, which include:

- Fixed remuneration: This is the compensation paid based on the level of responsibility and professional background. It is accrued in all cases and is reviewed and agreed annually by the Remuneration Committee.

- Variable remuneration: This is the compensation awarded based on the achievement of objectives over a one-year time horizon. The objectives are defined annually by the Remuneration Committee, and payment is approved the following year based on results. These objectives are aligned with both shareholder interests and broader societal goals (a portion of them is linked to various sustainability aspects of the company).

- Hiring bonuses or incentive payments: Compensation granted upon recruitment.

- Severance payments: Financial compensation provided in the event of contract termination, as stipulated in the employee’s contract.

- Reimbursements: Repayment of eligible expenses.

- Pension plan: A retirement scheme established to provide complementary social benefits in addition to the public pension system, for the benefit of plan participants.

The Committee is responsible for agreeing on the principles and structure of the proposed remuneration for all members of the Board of Directors and the Management Committee who are not covered by a Collective Bargaining Agreement (CBA). It is also tasked with considering how to attract, retain, and develop talent in collaboration with the CEO, as well as with establishing and reviewing succession plans.

The remuneration principles are based on:

- The creation of long-term value.

- The attraction, retention, and motivation of top professionals.

- Rewarding levels of responsibility and performance.

- Ensuring internal equity and external competitiveness.

- Ensuring pay equity between men and women.

The remuneration policies for all employees comply with good corporate governance practices. In accordance with Article 7 of Royal Decree 902/2020, a pay audit has been conducted alongside the Equality Plan (2022-2026). The action plan is included in the Measures section of the Equality Plan, specifically within the “Remuneration” block, and is monitored through the Plan’s follow-up process (see People chapter).

Part of the variable remuneration for management and the rest of the workforce has been linked for the past four years to ESG performance outcomes

The Remuneration Committee meets as often as necessary to ensure the proper performance of its functions. As a general rule, it holds a minimum of one or two meetings during the first four months of the year, although the number of sessions may increase when deemed necessary. In the 2024 fiscal year, the Committee held two meetings in the first quarter to present and validate remuneration proposals, as well as an additional meeting in the second half of the year to address specific needs. The Committee’s proposals are submitted to the Board of Directors.

Aligned with the commitment to sustainability, sustainable financing, and shareholder requirements, part of the variable remuneration for management and the rest of the workforce has been linked for the past four years to ESG performance outcomes, such as the GRESB index. Additionally, since 2023, new elements have been incorporated to evaluate contributions to the company’s ESG performance linked to achieving strategic objectives, including but not limited to:

- Implementation of approved measures in the Equality Plan.

- Deployment of renewable gas projects.

- Zero accidents with civil liabilities or sanctions related to environmental management.

- Growth in natural gas supply points through LPG conversion.

- ESG performance index from GRESB.

- Rating agency indices.

- Progress in the Data Driven project.

- Resilience and strengthening of cybersecurity plans.

- Update of the Compliance Training Plan.

- Achievement of Compliance control requirements.

- Human team development.

- Financial strength.

Management Committee

The Management Committee is a body composed of the General Manager or CEO of the Company and the heads of the six Business Unit Departments. These Business Unit Departments are staffed with individuals who possess extensive experience and competencies in the company’s key areas of activity. They bring operational and management proposals to the Committee that they consider appropriate or necessary for their respective Units and for fulfilling the Strategic Plan. Additionally, they act as a channel to communicate the interests, needs, and expectations of their stakeholders.

Executive decisions of the Management Committee are made by the General Manager or CEO of the Company.

The Management Committee is a body composed of the General Manager or CEO of the Company and the heads of the six Business Unit Departments

Their main responsibilities are:

- Definition and updating of the Mission, Vision, Values, policies, strategies, and objectives, which are communicated to the General Management to ensure compliance with the Company’s strategic plan, as well as their ongoing monitoring.

- Approval and monitoring of the Sustainability Master Plan and objectives related to sustainable development.

- Monitoring the overall performance and specific projects of the Company’s operational and business areas: expansion, customer operations, and network operations.

- General supervision of the achievement of economic, environmental, and social performance objectives.

- Engagement and involvement with stakeholders within their area of competence, delegating to the Risk Department the systematic and periodic identification of interests, needs, and expectations carried out by the organization.

- Definition of performance objectives by process and supervision of the evolution of the Company’s management indicator dashboard. Proposal and implementation of improvement actions.

- Monitoring of various transversal corporate matters considered relevant (regulation and legal compliance, sustainability, human resources, health and safety, environment, personal data protection, crime prevention, etc.).

The objectives and operating procedures of the technical committees and commissions identified in this chapter are detailed throughout the report, according to their respective areas of work or scope.

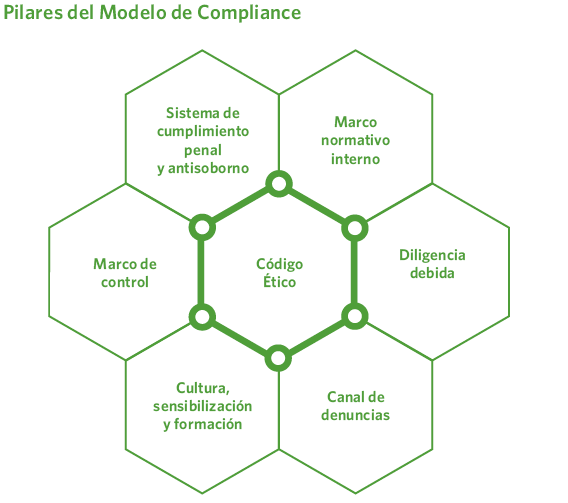

3.3Compliance model

The systematic identification of compliance obligations, risk analysis, and their implications for the activities, products, and services of Madrileña Red de Gas—both for fulfilling the strategic plan and minimizing legal and criminal risks—are the driving forces behind the development, implementation, and continuous improvement of a robust Compliance system, as well as the promotion of a culture of compliance and due diligence.

Legal compliance within the integrated management system is carried out through a systematic process of identifying and evaluating legal requirements, supported by an IT tool. Additionally, controls and compliance measures are established through internal regulations, and the risks arising from legal non-compliance are assessed across all areas of the company.

Madrileña Red de Gas provides the necessary tools to all its members and supply chain to promote the highest standards in ethics and compliance, respect for current laws and regulations, and zero tolerance for activities related to corruption or other illicit conduct.

In 2024, there were no fines or sanctions resulting from legal non-compliance.

Ethic Code

The Code of Ethics aims to establish guidelines that must govern the ethical behavior of all employees in their daily work, particularly concerning their relationships and interactions with all stakeholders—namely employees, customers, suppliers and external collaborators, shareholders, public and private institutions, and society at large.

Following the enactment of Law 2/2023, of February 20, regulating the protection of whistleblowers and combating corruption, and the revision of the whistleblowing channel, Madrileña Red de Gas conducted a review of the Code of Ethics in 2023.

Furthermore, the company promotes and encourages its suppliers and collaborating companies to adopt behavioral standards consistent with those defined in this Code of Ethics. To this end, a Supplier Code of Conduct has been developed, which has been incorporated into the new contractual clauses.

The Code of Ethics Committee is the body responsible for ensuring compliance with the Code. It is composed of four members appointed by the General Management based on their experience and knowledge, in addition to the head of the Internal Information System. The Committee members elect their chairperson by vote for a two-year term. The Committee’s operations are governed by the Code of Ethics itself.

The purpose of the Code of Ethics Committee is to:

- Promote the dissemination, awareness, and compliance of the Code of Ethics.

- Interpret the Code of Ethics and provide guidance in cases of doubt.

- Facilitate the resolution of conflicts related to the application of the Code.

- Provide and manage a communication channel for all employees, suppliers, and collaborating companies to report in good faith and without fear of retaliation any concerns or breaches of the Code of Ethics or any related information.

- Report to the governing bodies on the dissemination and compliance with the Code of Ethics, as well as on the Committee’s activities, preparing recommendations or proposals to keep it updated, improve its content, and facilitate the application of aspects requiring special consideration.

- Oversee compliance with the Code of Ethics and, where appropriate, analyze indications and reports related to potential breaches of the Code.

The Committee submits its proposals for approval by the General Manager.

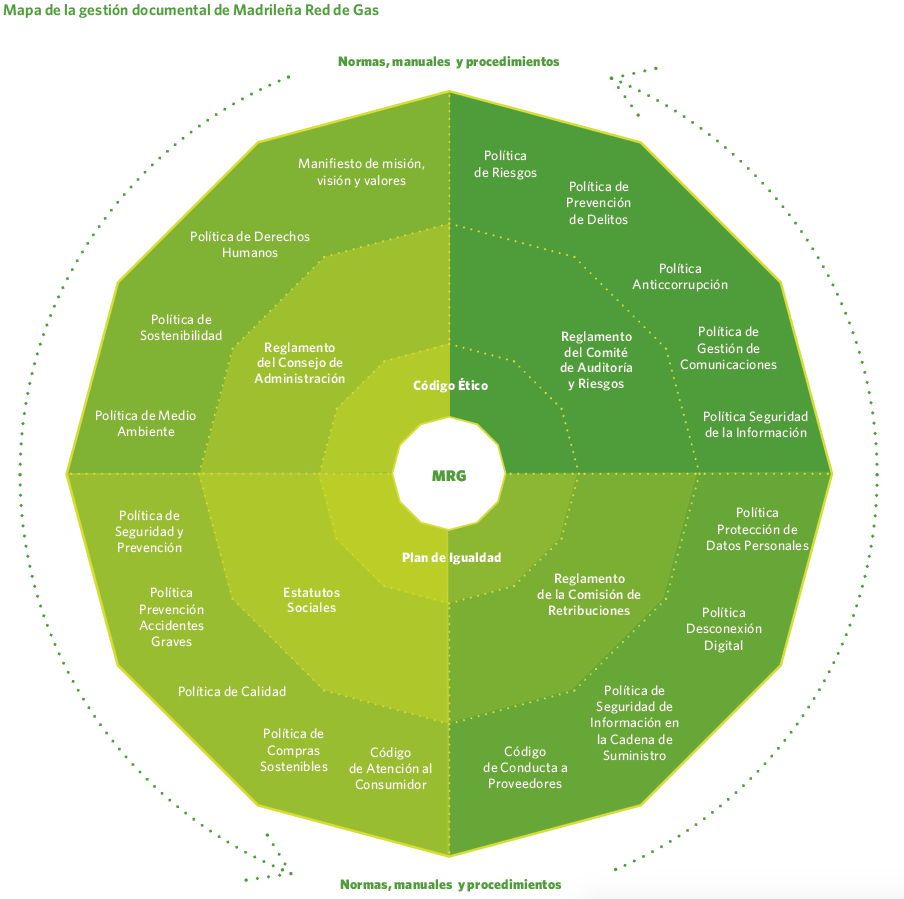

Internal regulatory framework

The principles underpinning Madrileña Red de Gas’s corporate governance and compliance system are embodied in a comprehensive set of regulations, policies, standards, manuals, and procedures.

Primarily, the regulations align with best corporate governance practices by establishing the rules for organization and operation, codes of conduct, and oversight and control mechanisms for governance bodies:

- Bylaws, registered with the Commercial Registry, governing the company’s general operation.

- Board of Directors Regulations.

- Audit and Risk Committee Regulations.

- Remuneration Committee Regulations.

The Mission, Vision, and Values of Madrileña Red de Gas, together with the Code of Ethics, constitute a behavioral model designed to ensure appropriate conduct in the professional performance of employees.

The policies reflect the company’s commitments and strategy towards proper business conduct, reinforcing its engagement with economic, environmental, social sustainability, and good governance in the short, medium, and long term

The policies reflect the company’s commitments and strategy towards proper business conduct, reinforcing its engagement with economic, environmental, social sustainability, and good governance in the short, medium, and long term. They also address the impacts and risks related to the company’s activities, laying the groundwork for adequate awareness, involvement, and management by employees, shareholders, and the value chain, and regulate relations with the various stakeholders. These policies are publicly accessible to all stakeholders at: https://madrilena.es/sostenibilidad/.

These policies are defined by the competent management areas, supervised by the Audit and Risk Committee, approved by the General Manager, and ultimately validated by the Board of Directors to ensure compliance and oversight.

Criminal compliance and anti-bribery system

Criminal Compliance

Within the framework of the Compliance System and as a result of the risk analysis at Madrileña Red de Gas, a Criminal Offenses Prevention Protocol has been defined and communicated internally, outlining the functional areas and the most sensitive activities where offenses to be prevented may occur. Madrileña Red de Gas is committed to the continuous review of the protocol based on analysis and control.

To this end, it has a Crimes Prevention Committee composed of the Chairwoman of the Board of Directors, the CEO, and the Compliance Officer.

The functions of this Committee can be summarized as follows:

- Review existing policies and ensure continuous compliance with legislative updates regarding risk prevention.

- Adapt established controls to minimize detected risks as much as possible.

- Review employee training programs, incorporating current updates or serving as reminders.

- Approve action plans and improvements proposed by the Compliance Officer.

The organization’s processes related to the company’s most operational aspects are defined by the Executive Committee and communicated to the Board of Directors whenever there may be a significant change.

Matters discussed in the Crimes Prevention Committee are escalated to the Audit and Risk Committee, which in turn reports to the Board of Directors, the ultimate body informed of all impacts. This delegation system efficiently manages all impacts that may affect the company across all areas.

Prevention of corruption and fraud

Madrileña Red de Gas maintains a firm commitment to combating corruption in all its forms by implementing specific preventive measures. To this end, the company has adopted an Anti-Corruption Policy. In line with this policy, Madrileña Red de Gas publicly expresses its determination not to exert influence over the will of third parties to obtain benefits through unethical practices. Likewise, no employee or professional linked to the organization is authorized to offer or accept, directly or indirectly, payments, gifts, or any type of compensation that could improperly affect their commercial, professional, or administrative relationships, whether in the public or private sector.

The risks associated with any criminal activity within the organization, including corruption, fraud, or conflicts of interest, are overseen by the Board of Directors through the Audit and Risk Committee, which helps prevent or mitigate such risks to the greatest extent possible. To date, no cases of corruption have been detected.

Board members, upon detecting a conflict of interest, must inform both the Board of Directors and the Company itself. This communication is documented and included in the Company’s report. Furthermore, as established by the Capital Companies Act, for cases where a potential future conflict of interest is foreseen, Article 230 of the same legal text sets forth a waiver procedure for specific cases, which will be carried out, depending on the case, either by the Board itself or, if applicable, by the sole shareholder.

The risks associated with any criminal activity within the organization, including corruption, fraud, or conflicts of interest, are overseen by the Board of Directors through the Audit and Risk Committee

In 2024, no breaches related to criminal risks or risks associated with internal or external corruption were detected.

Additionally, all contracts with suppliers and contractors include penalty clauses concerning legislative compliance and criminal liability. Contracts require compliance at all levels: labor (Occupational Risk Prevention, social security contributions, mandatory training for activities, etc.) and business (tax compliance, activity accreditations, etc.).

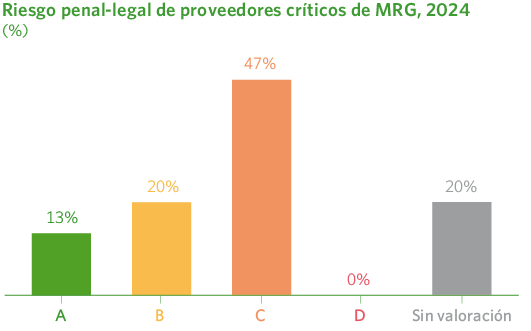

The monitoring of suppliers’ ESG performance through the supplier prequalification portal, following its own risk methodology, allows the evaluation of the current status of collaborating companies under various regulatory frameworks, specifically in legal and criminal matters (Image 15).

Verifications related to the Anti-Money Laundering (AML) Law and sanctions are regulated by Law 10/2010, of April 28. According to this law, Madrileña Red de Gas is not obligated to perform AML (Anti-Money Laundering) or sanctions verifications. However, the Supplier Evaluation Platform (which verifies ESG audit scores for critical suppliers, outstanding tax payments, compliance questionnaires, etc.) has included a new KPI that reports whether a company, its management team, or its shareholders appear on any international sanctions list.

In the 2024 evaluation, no supplier was rated as having a very high criminal risk. It is noteworthy that 47% of critical suppliers were rated with high criminal risk, compared to 57% in the previous year. Additionally, 33% of critical suppliers were rated as medium or low risk, and 20% were not evaluated—either because they are not registered on the platform or because there was insufficient information to assess their criminal risk.

Whistleblowing channel

It is important to highlight that, in compliance with Law 2/2023, of February 20, regulating the protection of persons reporting regulatory infringements and combating corruption, the company updated its whistleblowing channel, operational since 2015 and outsourced to a reputable company in the sector, with the aim of strengthening guarantees of confidentiality, protection, and non-retaliation for those who report possible irregularities through this mechanism.

In this regard, and following the appropriate consultation with employee representatives, the Board of Directors approved in 2023 a series of additional measures to adapt the internal information system to the new regulation, including:

- Appointment of the person responsible for the company’s Internal Information System, in charge of managing the channel and ensuring compliance with legal requirements.

- Approval of the Information Management Policy, establishing guiding principles and criteria for receiving, processing, and monitoring communications.

- Approval of the Information Management Procedure, regulating the processing of reports and guaranteeing due diligence in their handling.

- Update of the company’s Code of Ethics, reinforcing commitments to integrity, transparency, and regulatory compliance.

These updates ensure that the whistleblowing channel remains an effective tool for detecting and preventing irregular conduct, aligned with the highest standards of corporate governance, legal compliance, and business ethics.

Reports received through the Whistleblowing Channel are discussed and analyzed by the Code of Ethics Committee and are forwarded to the appropriate area based on their content, along with the agreed considerations.

This channel is available online (https://www.canaldedenuncias.com/es/madrilena). In 2024, it was available and operational 100% of the time.

There have been no significant cases of legal or regulatory non-compliance, nor fines paid as a result of final judicial rulings during the reporting period.

During the past year, no reports were received via the channel concerning possible cases of corruption or violations of the Code of Ethics. Likewise, the company has not been investigated or convicted by any court for corruption-related breaches, consistent with previous years.

In 2024, 12 inquiries or complaints related to the company’s normal operational activities were received through the channel; these were routed through the appropriate channels for management, none related to the Compliance system and therefore not classified as whistleblower reports.

Control framework

During the course of activities and on an ongoing basis, monitoring and evaluation of the compliance program is carried out, providing a reasonable level of assurance. The control monitoring activity has been delegated from the Risk function to the executors and owners of the controls.

In 2024, an evaluation of the compliance status within the organization was conducted again, analyzing its level of implementation and effectiveness to understand the compliance measures and control measures implemented, as well as to prevent and detect criminal risks. Control evaluations have been managed through a specific Compliance risk management tool that allows sending control assessments to the executors and owners of the controls.

The specific scope of the supervision activity includes a list of infringements that may impact Madrileña Red de Gas:

Key highlights

- As in 2023, the 124 controls evaluated in 2024 (with 100% of the processes completed) were classified as “Adequate,” with none rated as “Partially Adequate” or “Not Adequate.” This consistency in results reinforces the robustness of the company’s internal control framework. The ongoing alignment of monitoring activities with risk assessment objectives has ensured the effectiveness of measures implemented to mitigate compliance risks.

- Regarding “Crimes against workers’ rights,” a key potential risk for Madrileña Red de Gas, continuous improvement of controls over recent years has been so significant that the previous gap between potential risk and control robustness has been fully closed. Among these controls, highlights include:

- Strict compliance with current occupational health and safety legislation.

- Provision of safe and healthy working conditions.

- Ongoing evaluation and improvement process through auditing procedures.

- Concerning potential infractions related to cybersecurity, significant improvements to controls were already implemented in 2023. In 2024, these controls remain in force, ensuring continuous compliance and resilience in cybersecurity matters. The strength of these controls is further supported by the maintenance of the ISO 27001 management system and ongoing cybersecurity training initiatives implemented at Madrileña Red de Gas in recent years.

- As a continuation of measures implemented in previous years, following the enactment of Organic Law 10/2022 on comprehensive guarantees of sexual freedom, the crimes of degrading treatment and sexual harassment were incorporated into the Control Matrix in 2022. In 2024, these controls remain fully operational and are effectively applied, with no incidents reported to date.

- As every year, a review was conducted to update and evaluate the compliance risk related to crimes included in the Company’s risk map, to reflect the current exposure to the risk of behaviors and actions that may breach the applicable regulations and entail liability for Madrileña Red de Gas.

- As part of the methodology, an Action Plan for the upcoming year has been established, with an emphasis, as always, on awareness and training in Compliance matters.

The information and actions resulting from this process have been assessed by the Audit and Risk Committee, as well as by the Board of Directors in the Governance, Ethics, and Compliance chapter.

Compliance culture, awareness and training

The Criminal Offenses Committee, as the body responsible for approving crime prevention and anti-corruption policies, the crime prevention protocol, the annual Compliance review report, and the annual action plans based on detected needs, among other duties, is also in charge of deploying, where applicable, general and specific training actions on criminal offense prevention. These are aimed at the company’s executive governing bodies (General Director, Area Directors, and Department Heads), as well as the rest of the employees.

For the Madrileña Red de Gas compliance team, it is very important that all employees are familiar with the irregularities reporting system, which requires continuous communication

During 2024, the annual awareness and training plan on compliance culture continued to be delivered through various communication actions, including the irregularities reporting system and dissemination of short educational and informative modules on key aspects of the Compliance System. For the Madrileña Red de Gas compliance team, it is very important that all employees are familiar with the irregularities reporting system, which requires continuous communication. For example, new employees are informed about the reporting system during their welcome session, and periodic information campaigns (such as emails and posters) are conducted throughout the year.

In 2024, the following specific training was delivered:

- Basic Compliance Training: Basic criminal offense prevention training provided to all personnel regardless of their professional category or hierarchical level. This training is currently given as part of the onboarding plan upon joining the company. The course lasts one hour and is delivered online, with training effectiveness recorded through a questionnaire assessing knowledge acquired. In 2024, this training was delivered to 5 people (4% of the workforce), none of whom were members of the Management Committee.

- Criminal Compliance Training (Image 18). In 2023, an external refresher and update course on Criminal Offense Prevention was conducted, reaching 92% of the workforce. In 2024, this course was offered again to those who, for various reasons, could not take it in 2023. The course was delivered online, with effectiveness measured through a questionnaire on the knowledge gained. It is noteworthy that 100% of the workforce completed this course during the 2023-2024 period. A new training session is planned for 2025.

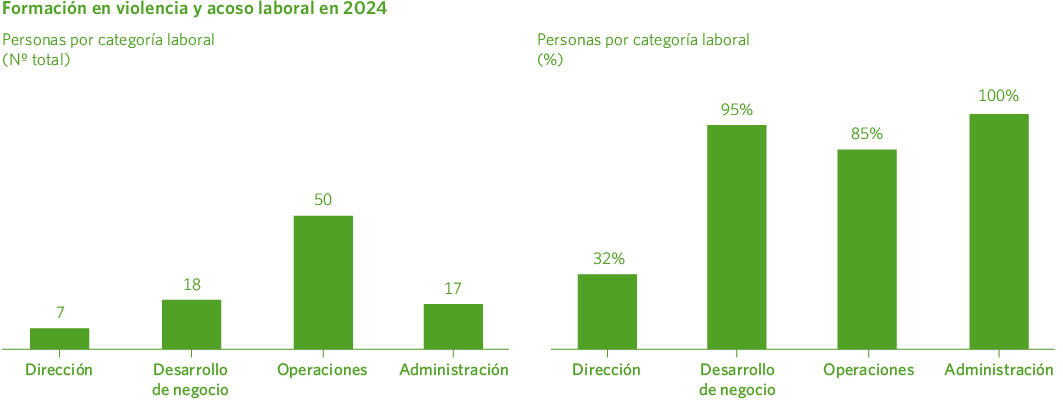

- Training on Prevention and Awareness of Workplace Violence and Harassment: this year, training was provided to 92 people (79% of the workforce) during November 2024, reinforcing the training already conducted in 2023. The course lasted one hour and was delivered online.

- The members of the Board, in addition to receiving training on Good Governance Practices (see the competency evaluation charts of the Board), are systematically informed during the meetings of the Audit and Risk Committee about policies, compliance risk assessments, and the annual system review. New members who joined in the last quarter of the year participated in the information session during the final quarter 2024 meeting, under the section on Governance, Ethics, and Compliance.

- Communication is reinforced during team meetings throughout the year.

Likewise, all suppliers and contractors are informed of and required to comply with legal obligations at all levels, through clauses on legislative compliance and criminal liability.

Human Rights Due Diligence

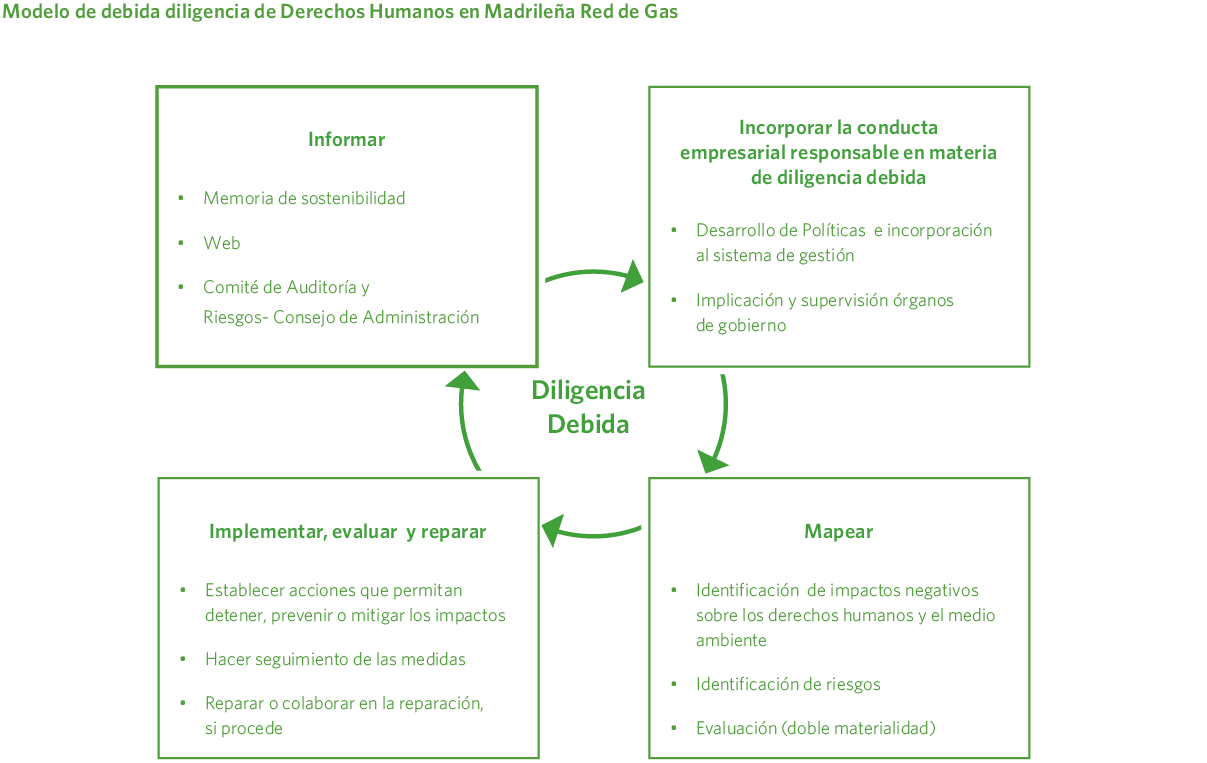

For Madrileña Red de Gas, Due Diligence in sustainability is understood as the set of actions or measures the organization takes to identify and address negative impacts, prevent and mitigate them, monitor the implementation and results, and report on how these negative impacts affecting people and the environment are managed — both in its own activities and those of its suppliers and customers.

The due diligence model (Image 20) defined at Madrileña Red de Gas can be summarized in four main stages. In 2024, the company began structuring the due diligence model and actions that had been previously carried out within the organization, aiming to gradually implement and systematize it over the coming years on a voluntary basis, since it is not yet subject to the due diligence requirements of the CSRD Directive for Reporting, nor the CSDDD Directive on due diligence.

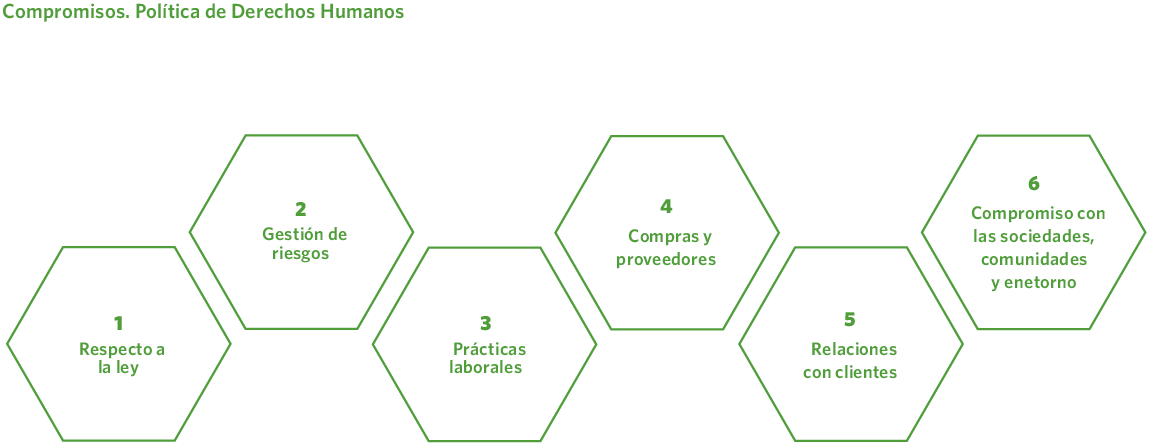

Incorporating business conduct in Due Diligence

Since 2021, Madrileña Red de Gas has had a Human Rights Policy (Image 21), based on the UN Guiding Principles on Business and Human Rights, which reflects the company’s behaviors and reinforces its commitment to respecting and promoting Human Rights across all its operations and in all communities where it operates, with special attention to vulnerable groups, as also established in its Code of Ethics. This commitment extends to suppliers through the Sustainable Purchasing Policy and the Supplier Code of Conduct, as well as contractual specifications regarding Human Rights and legal compliance, thereby extending its due diligence commitment throughout its supply chain.

The policy applies to all employees, executives, and the Board of Directors, covering all activities carried out by the company. Its compliance is ensured through the evaluation mechanisms of the compliance system.

Additionally, Madrileña Red de Gas has an Information Management Policy that establishes guiding principles and criteria for handling, processing, and monitoring reports of irregularities. It has also approved an Information Management Procedure that regulates the processing of complaints and guarantees due diligence in their management.

Moreover, Madrileña Red de Gas has a governance structure that facilitates supervision and monitoring of actions regarding due diligence on people and the environment, promoting the United Nations Guiding Principles on Business and Human Rights, both in the company’s own operations and those of its suppliers.

Mapping

The Due Diligence Model is based on the risk management framework and impact analysis within the double materiality process, where actual or potential impacts on compliance with the principles of respect for Human Rights or the environment are identified.

This systematic approach will enable Madrileña Red de Gas to evaluate and prioritize negative impacts based on their severity or gravity (scale, scope, and remediation) and the likelihood of occurrence, as well as the associated risks. In 2024, a series of risks related to Human Rights due diligence were identified and will be assessed in the next double materiality exercise.

Implement, Evaluate and Remediate

This Model is based on the principles of protection, respect, and remediation, aimed at fulfilling the commitments established in this policy and the behaviors set forth in the Code of Ethics itself. To that end, it has established the following review mechanisms:

- The Board of Directors is responsible for approving and overseeing the Company’s overall Human Rights strategy, from which this Policy derives.

- The Risk Manager is responsible for conducting the human rights risk assessment, reporting to the Audit and Risk Committee.

- The Audit and Risk Committee is periodically informed about the implementation and performance of this Policy and the Code of Ethics by the Organization as a whole, with the aim of monitoring and evaluating the level of implementation and effectiveness of the Policy to manage the protection of Human Rights.

- Madrileña Red de Gas has implemented an ethics channel, including communication and whistleblowing channels, to ensure the handling and remediation of possible irregularities, including violations or abuses of Human Rights.

- Any threat with potential impacts on the economy, environment, and people may be analyzed by the Management Committee to determine the likelihood and magnitude of the impact, as well as to define the corresponding mitigation plan.

Given the regulated activity and the geographical environment in which it operates, there is no high risk of non-compliance. Nonetheless, Madrileña Red de Gas makes available the tools accessible to all its stakeholders (see Sustainability Strategy chapter), with special emphasis on the labor environment of the supply chain and the supply of gas to vulnerable people due to energy poverty, following the applicable regulations in this regard.

The result of the analysis will allow Madrileña Red de Gas to implement mitigation or remediation measures and integrate them into the company’s own processes.

In 2024, no human rights risks materialized in the operations of Madrileña Red de Gas

Reporting

Through the transparency and accountability process via the publication of the sustainability report, Madrileña Red de Gas will disclose its due diligence management model and the possible impacts generated to all its stakeholders.

Internally, reporting will be conducted through the various involved Committees.

In 2024, no human rights risks materialized in the operations of Madrileña Red de Gas.